Groups Help Members Untangle “Fiscal Cliff” Fallout

The just-passed "fiscal cliff" legislation offers opportunities for associations to help members sort out the law's impact on their lives.

With the “fiscal cliff” battle behind us, Americans are breathing a sigh of relief.

Now, associations—especially those in the financial space—have their work cut out for them: explaining what the American Taxpayer Relief Act of 2012 means for their members. Here’s how some associations are handling the situation:

The National Association for Tax Professionals highlights on its website resources that tax preparers will need this season to help them serve their clients. NATP points out the redesign of the IRS website and offers tips to help members update their IRS profiles. The page notes important changes for the 2013 tax season, such as the absence of a Refund Cycle Chart (a big question from clients), and explains how to help taxpayers file for tax relief in disaster situations such as Superstorm Sandy.

The National Small Business Association details the new tax regulations in a statement on its webpage, focusing largely on small business credits and changes in take-home pay and the alternative minimum tax.

For a more extensive look at the fiscal cliff, the nonprofit Committee for a Responsible Federal Budget drills down into the deal with a line-item budget, charts to explain differences in payroll tax and how it affects income, and a slew of policy papers and helpful blog posts.

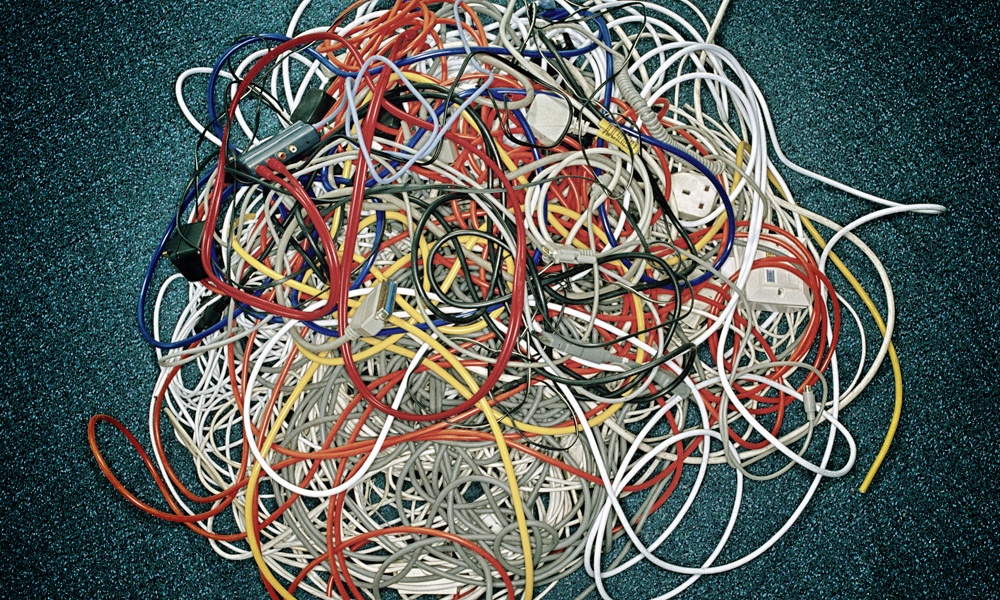

(Chris Windsor/Getty Images)

Comments