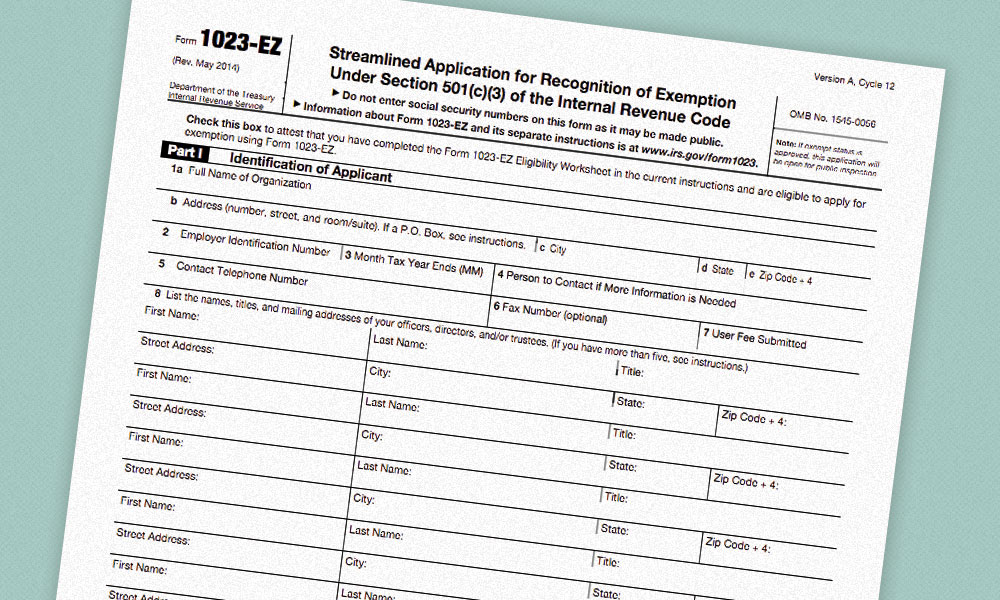

IRS Introduces New Short Application Form for 501(c)(3) Tax Exemption

A proposed new "EZ" application form for 501(c)(3) tax-exempt status would take drastically less effort to complete and speed processing time, says the IRS. The agency is accepting comments on the form until April 30.

Faced with a backlog of applications and fewer resources to get them processed,the Internal Revenue Service is proposing a drastically streamlined Form 1023-EZ for certain groups applying for 501(c)(3) tax-exempt status.

The Form 1023-EZ would allow charities to avoid the longer Form 1023 if they have annual revenues of less than $200,000 and assets less than $500,000. The two-page draft Form 1023-EZ is out for public comment until Wednesday, April 30. The longer Form 1023 is currently 25 pages and takes 101 hours on average to complete.

The IRS estimates that approximately 17 percent of 501(c)(3) applicants each year will be able to use the shorter form, which it says will take about 14 hours to complete.

The IRS receives about 60,000 applications for tax exemption a year, according to the 2013 annual report of its Taxpayer Advocate Service (TAS), with 80 percent of those being applications for 501(c)(3) status. Automatic revocations, which occur when a tax-exempt organization fails to file a Form 990 information return for three consecutive years, have added another 50,000 requests for reinstatement to the Exempt Organization unit’s workload.

“Its inventory backlog now stands at about 66,000 cases, more than the number of initial applications it usually receives in an entire year, four times the 2010 level, and more than triple the 2011 level,” TAS reported.

(Associations Now illustration)

Comments