Despite Touting IRS Progress, Koskinen Faces Republican Ire

IRS Commissioner John Koskinen told Senate Finance Committee members that the agency was moving forward with recommendations related to the targeting of certain tax-exempt organizations, while House Republicans announced they will pursue his impeachment.

IRS Commissioner John Koskinen reassured Senate Finance Committee members last week that his agency was progressing with recommendations related to the targeting of certain tax-exempt organizations, while Republicans on the other side of the Capitol announced they will pursue his impeachment.

A resolution to begin impeachment proceedings was introduced this week by House Oversight and Government Reform Committee Chairman Jason Chaffetz (R-UT) and 18 members of the committee, who cited Koskinen’s failure to locate and preserve emails related to the IRS’s handling of certain applications for tax-exempt status and for providing false and misleading information during testimony.

“Commissioner Koskinen violated the public trust,” Chaffetz said. “He failed to comply with a congressionally issued subpoena, documents were destroyed on his watch, and the public was consistently misled. Impeachment is the appropriate tool to restore public confidence in the IRS and to protect the institutional interests of Congress.”

The Senate Finance Committee scheduled the hearing last week to discuss the IRS’ response to the committee’s report on the agency’s admitted use of improper criteria in reviewing applications for 501(c)(4) tax-exempt status several years ago. The committee’s 375-page report was released this summer following a two-year investigation into the IRS targeting of conservative-sounding political groups.

Koskinen, who took over the IRS top job in the aftermath of the targeting scandal, touted the IRS’s full cooperation with the committee during its investigation and said the agency has already taken a number of significant actions to prevent any perceived political bias in the processing of tax-exempt applications, including streamlining the exempt organizations determination process and realigning staff and organizational functions to improve service to the tax-exempt sector. The IRS has also ramped up training for employees on political campaign intervention and created a formal process for them to request assistance from technical experts if they have questions when processing requests for tax-exempt status, Koskinen said.

Part of the reason for EO’s improved application review process was the introduction last year of a streamlined application form for tax-exempt status. The Form 1023-EZ is three pages long (as opposed to the standard 26-page Form 1023) and is available to small nonprofits with an annual income of $50,000 or less and assets under $250,000. The new form has enabled the IRS to speed up the approval process for smaller organizations and clear a backlog of more than 60,000 tax-exempt applications over the past year.

During the hearing, Senate Finance Committee Chairman Orrin Hatch (R-UT) expressed support for Koskinen and said he trusts that he is operating in the public interest. “I’ll get in trouble with the House for saying this, but I have a high opinion of you, and basically think that you are trying to put things in order and I’m going to count on you doing that,” Hatch told Koskinen.

While only a majority is needed in the House to impeach an official, it would require a trial and finding of guilt in the Senate. The Department of Justice said last week that it found no evidence to warrant criminal charges against IRS officials regarding the tax-exempt targeting scandal.

“The IRS mishandled the processing of tax-exempt applications in a manner that disproportionately impacted applicants affiliated with the Tea Party and similar groups,” said Assistant Attorney General Pater Kadzik in a letter to Congress. “However, ineffective management is not a crime.”

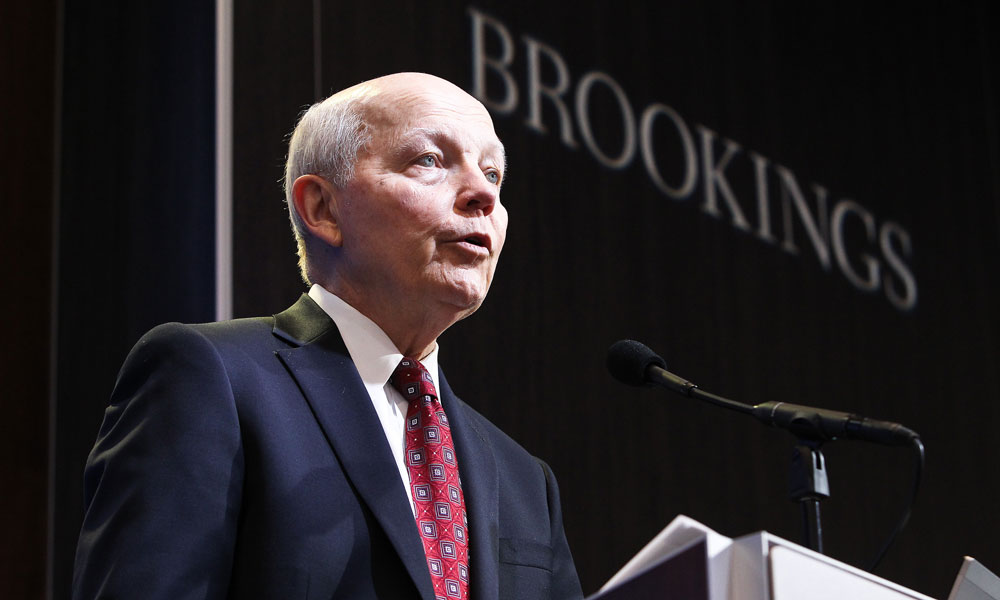

IRS Commissioner John Koskinen. (Brookings Institution/Flickr)

Comments